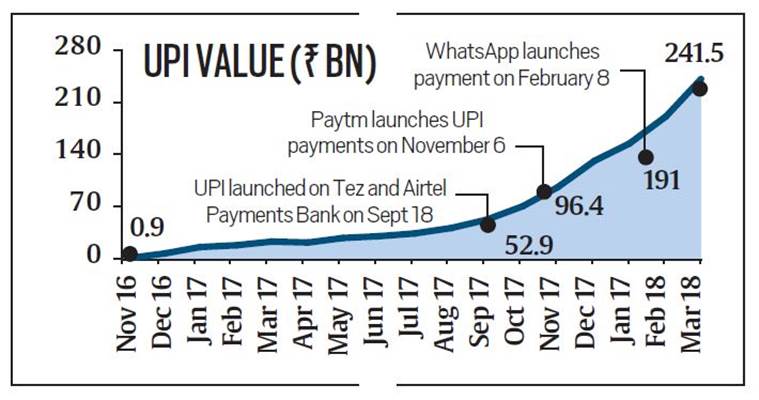

When the Unified Payments Interface (UPI) was launched in April 2016, it was expected to be the banks’ answer to compete with the digital payment platforms, particularly wallets, that were gaining traction. Two years later, even though banks remain underlying for money transfer made through UPI, third-party platforms such as Google Tez, WhatsApp and Paytm have driven the growth of the platform. Data sourced from Reserve Bank of India (RBI) and National Payments Corporation of India (NPCI) show that at Rs 50.46 billion, the monthly addition in the value of UPI transactions in March 2018 was over ten times from March 2017. The growth in usage started exploding since September 2017, when UPI went live on Google Tez and Airtel Payments Bank.

Mobile Phone Apps

Even after September, when these two platforms were launched, there were sudden surges in UPI value in the succeeding months when other platforms launched their UPI offerings. While it may not be directly attributable to one particular service, following the beta launch of UPI payments on WhatsApp, transaction value grew from Rs 155.4 billion in January to Rs 241.5 billion in March.

In volume terms, too, the growth was visible. Following the launch of UPI on Google Tez and Airtel Payments Bank, the volumes doubled in a month to 30.8 million in September from 16.6 million in August 2017. Compared with August, the UPI volumes in March were more than ten times higher at 177.9 million.

Digital Payments

Traditionally, digital payment companies, particularly those in the prepaid wallet business have used cash back as a marketing technique to lure in new customers leading to an inorganic growth in the number of users. Other players in the fray offering UPI-based payment services are NPCI-run BHIM, or Bharat Interface for Money, Flipkart-owned PhonePe, Axis Bank-owned FreeCharge, apart from mobile apps of all the major banks. Notably, according to NPCI data, transactions on BHIM in value terms during the 12-month period ended March 2018 were around 27 percent of the total UPI transaction amount.

In April 2016, NPCI launched a pilot programme of UPI with 21 banks that went live. As of April 2018, there are 95 banks on board the UPI system. NPCI says that UPI caters to the peer-to-peer payments in particular and offers a unique proposition in form of availability of all bank accounts through a single app. Further, for the customer, the platform brings benefits such as round the clock availability, use of a virtual ID which is deemed to be more secure as there is no credential sharing and single click authentication.

Click here & check our Web IT Solutions Services

Source: Indian Express